Bright Cash

Information

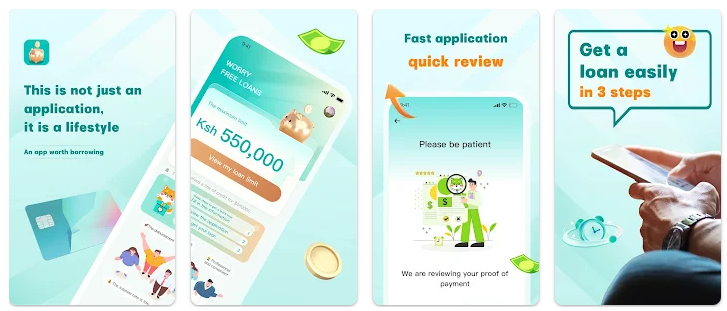

Bright Cash is a modern financial solution designed to help individual users in Kenya access funds conveniently right on their mobile phones. The app allows you to proactively apply for a loan, track your loan status, and receive disbursement in the shortest possible time.

BrightCash is operated by Payablu Finance Company and is committed to delivering a reliable lending experience with transparent interest rates and dedicated customer support, helping you easily handle everyday financial needs.

Experience simple lending on the app

Step 1: Download Bright Cash App on Google Play and register using your phone number.

Step 2: Provide accurate personal information and the required data as instructed.

Step 3: Once approved, the loan amount will be transferred directly to your bank account.

Borrowers should repay on time or choose early repayment according to their needs. Early repayment may qualify you for interest rate discounts or higher limits on your next loan. Payablu Finance Company applies strict security standards and does not share customers’ personal information with any third party without consent. Wishing everyone a successful registration.

See more:

Loan Calculator

Number of Loans

Top Best Loan Apps

All

-

Loan amounKES 2.000 to KES 90,000

-

Loan term91 to 210 days

-

Fire Loan interest rate(APR) up to 19%

-

Loan service feesFree for first-time borrowers

-

Registration requirementsYou just need to be 18 years old

-

Payment supportPayment via registered bank account

-

Loan amountFrom 1,500 KSH to 50,000 KSH

-

Loan term91 to 365 days, including possible extensions

-

Interest rateUp to 18% per year (about 0.05% per day)

-

Service feeNo upfront fees, no hidden charges

-

EligibilityKenyan residents aged 20+, with a smartphone

-

DisbursementSame-day payout to bank account or M-Pesa

-

Loan amountFrom KES 6,000 - KES 50,000

-

Loan termFrom 120 - 180 days

-

Interest rate12% – 36% comprehensive annual rate

-

Service feeOne-time processing fee

-

EligibilityKenyan citizen, age 20–65, stable income

-

Loan disbursementReceive money via M-Pesa account

-

Loan amountFrom 5,000 Ksh to 550,000 Ksh

-

Loan termFrom 91 – 180 days

-

Interest rateAPR 15% – 20% (max 0.05% per day)

-

Service feeNo hidden fees; all costs shown upfront

-

EligibilityValid ID and active bank account required

-

DisbursementFunds sent directly to your bank account