Helasasa

Information

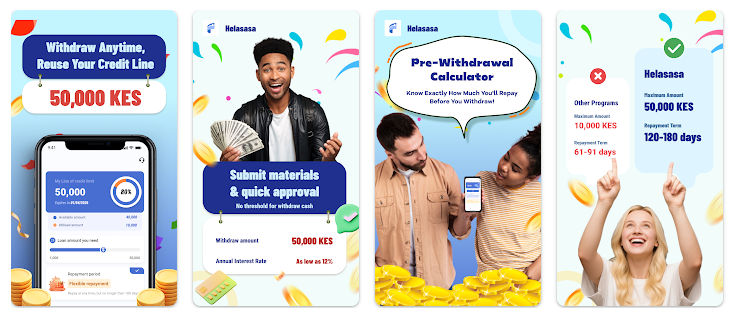

Helasasa is a Personal Line of Credit (PLOC) product that provides you with a pre-approved credit limit in Kenya. After the credit limit is approved, you can:

- Withdraw funds at any time

- Make multiple withdrawals whenever you need

However, you only need to withdraw the amount that matches your personal needs, as long as it does not exceed the approved credit limit. In addition, you are entitled to repay the loan flexibly within the agreed maximum repayment period. Interest is charged only for the period during which you actually use the loan. After completing the repayment, the amount you have repaid will automatically be added back to your available credit limit, allowing you to continue using it for future needs.

Download the Helasasa App now on Google Play to experience a fast, flexible, and secure financial solution right on your mobile phone. If you need support or have any questions during use, our customer care team is always ready to assist you via phone, email, or official contact channels. Helasasa is committed to delivering transparent, reliable services and timely support so you can enjoy financial peace of mind every day.

See more:

Loan Calculator

Number of Loans

Top Best Loan Apps

All

-

Loan amounKES 2.000 to KES 90,000

-

Loan term91 to 210 days

-

Fire Loan interest rate(APR) up to 19%

-

Loan service feesFree for first-time borrowers

-

Registration requirementsYou just need to be 18 years old

-

Payment supportPayment via registered bank account

-

Loan amountFrom 1,500 KSH to 50,000 KSH

-

Loan term91 to 365 days, including possible extensions

-

Interest rateUp to 18% per year (about 0.05% per day)

-

Service feeNo upfront fees, no hidden charges

-

EligibilityKenyan residents aged 20+, with a smartphone

-

DisbursementSame-day payout to bank account or M-Pesa

-

Loan amountFrom KES 6,000 - KES 50,000

-

Loan termFrom 120 - 180 days

-

Interest rate12% – 36% comprehensive annual rate

-

Service feeOne-time processing fee

-

EligibilityKenyan citizen, age 20–65, stable income

-

Loan disbursementReceive money via M-Pesa account

-

Loan amountFrom 5,000 Ksh to 550,000 Ksh

-

Loan termFrom 91 – 180 days

-

Interest rateAPR 15% – 20% (max 0.05% per day)

-

Service feeNo hidden fees; all costs shown upfront

-

EligibilityValid ID and active bank account required

-

DisbursementFunds sent directly to your bank account