AsapKash

Information

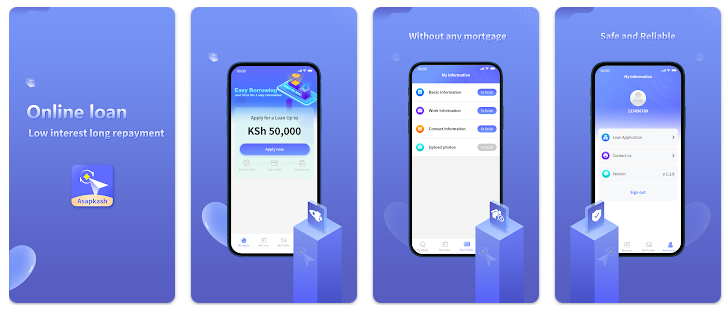

AsapKash was built with the mission of providing a stress-free loan solution for users in Kenya. The app helps users take control of their finances and feel secure using money when it is urgently needed. Funds for medical expenses, personal consumption, tuition fees, and more are ensured without having to worry about anything.

ZEROX TECHNOLOGY COMPANY LIMITED understands that in life, everyone sometimes needs money quickly. Therefore, Asap Kash provides a safe, convenient, and fully online lending channel, helping you address immediate financial needs without collateral or complicated procedures.

Outstanding advantages of the Asapkash App:

- A registration process of only 3 steps, fast and easy to complete

- No in-person meeting, no collateral, no upfront fees

- Users register on their mobile phones and receive disbursement on the same day

- Transparent interest rates, not focused on high-interest lending

Asap Kash is committed to delivering high-quality loan products with low interest rates, helping you borrow money with confidence and without worrying about financial burdens. Use future income to smartly address current needs. Download Asap Kash App on Google Play and borrow with confidence, worry-free finances.

See more:

FAQ

AsapKash is an online lending application in Kenya, managed and developed by ZEROX TECHNOLOGY COMPANY LIMITED, helping users borrow money quickly, safely, and transparently right on their mobile phones.

Kenyan citizens aged 20 and above, with a smartphone, a valid phone number, and complete personal information can apply.

You can repay via M-Pesa, bank transfer, or other payment channels supported by Asap Kash.

If repayment is late, late fees may be incurred in accordance with the loan agreement. You should repay on time to avoid unnecessary costs.

Loan Calculator

Number of Loans

Top Best Loan Apps

All

-

Loan amounKES 2.000 to KES 90,000

-

Loan term91 to 210 days

-

Fire Loan interest rate(APR) up to 19%

-

Loan service feesFree for first-time borrowers

-

Registration requirementsYou just need to be 18 years old

-

Payment supportPayment via registered bank account

-

Loan amountFrom 1,500 KSH to 50,000 KSH

-

Loan term91 to 365 days, including possible extensions

-

Interest rateUp to 18% per year (about 0.05% per day)

-

Service feeNo upfront fees, no hidden charges

-

EligibilityKenyan residents aged 20+, with a smartphone

-

DisbursementSame-day payout to bank account or M-Pesa

-

Loan amountFrom KES 6,000 - KES 50,000

-

Loan termFrom 120 - 180 days

-

Interest rate12% – 36% comprehensive annual rate

-

Service feeOne-time processing fee

-

EligibilityKenyan citizen, age 20–65, stable income

-

Loan disbursementReceive money via M-Pesa account

-

Loan amountFrom 5,000 Ksh to 550,000 Ksh

-

Loan termFrom 91 – 180 days

-

Interest rateAPR 15% – 20% (max 0.05% per day)

-

Service feeNo hidden fees; all costs shown upfront

-

EligibilityValid ID and active bank account required

-

DisbursementFunds sent directly to your bank account