Bora Credit

Loan amount

From 500 Ksh to 50,000 Ksh

Loan term

From 91 days up to 180 days

Interest rate

APR ranging from 36% to 72%

Service fee

Service fee is 100 (free).

Eligibility

Borrowers must be at least 18 years old

Loan disbursement

Fast disbursement via M-Pesa after approval

Information

Operating registration area

Kenya

Age requirement

Applicants must be at least 18 years old

Income requirement

A stable source of income is required

Phone number requirement

Active mobile number with M-Pesa support

Payment method

Repayment via M-Pesa

Document requirement

Valid national ID issued in Kenya

Initial loan amount

Starting from 500 Ksh

First loan interest rate

APR between 36% and 72%

New customer benefits

Zero service fees

Loan interest rate

APR 36% – 72%

Loan duration

91 to 180 days

Approval time

Fast approval, usually within a short time

Loan service fees

Service fee is 100 (free).

Late payment fees

Applicable according to system policies

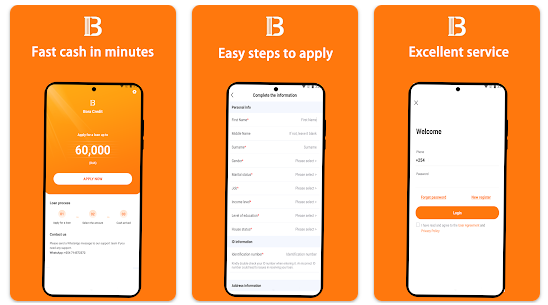

Bora Credit is a fast and reliable loan application for people in Kenya. Borrowers can complete a simple loan registration process, receive quick approval, and enjoy convenient disbursement via M-Pesa.

BoraCredit is developed and managed by Ceres Tech Limited, helping users easily handle unexpected expenses. The app offers flexible loan limits, transparent fees, and a strong commitment to data security.

Simple loan application process

- Register using your M-Pesa number

- Enter your desired loan amount

- Wait for approval and receive funds quickly

- Repay on time to increase your loan limit

At the Bora Credit App, customer privacy and information security are always our top priorities. Your personal information will never be shared with third parties. If you need support or consultation, please leave a comment below the post and we will assist you as soon as possible.

See more:

Loan Calculator

Based on the loan amount

Enter all the required parameters into the calculator to get an accurate monthly payment along with a visual representation of the interest percentage

I want to borrow

Term / Days

%/day

Loan Amount

10 000 000

$

Interest

70 000

$

Total Repayment

10 070 000

$

Annual Interest Rate

18

%

Number of Loans

Author:

Wena Rose De Leon

I am Wena Rose De Leon, a content specialist in personal finance and credit. With many years of professional experience and in-depth research into online lending models, I am committed to delivering accurate, easy-to-understand, and highly practical information about online loan platforms. My goal is to be a trusted companion, helping you access fast, transparent, and suitable borrowing solutions so you can make smarter and safer financial decisions.

Your Comment

Top Best Loan Apps

All

0

-

Loan amounKES 2.000 to KES 90,000

-

Loan term91 to 210 days

-

Fire Loan interest rate(APR) up to 19%

-

Loan service feesFree for first-time borrowers

-

Registration requirementsYou just need to be 18 years old

-

Payment supportPayment via registered bank account

0

-

Loan amountFrom 1,500 KSH to 50,000 KSH

-

Loan term91 to 365 days, including possible extensions

-

Interest rateUp to 18% per year (about 0.05% per day)

-

Service feeNo upfront fees, no hidden charges

-

EligibilityKenyan residents aged 20+, with a smartphone

-

DisbursementSame-day payout to bank account or M-Pesa

0

-

Loan amountFrom KES 6,000 - KES 50,000

-

Loan termFrom 120 - 180 days

-

Interest rate12% – 36% comprehensive annual rate

-

Service feeOne-time processing fee

-

EligibilityKenyan citizen, age 20–65, stable income

-

Loan disbursementReceive money via M-Pesa account

0

-

Loan amountFrom 5,000 Ksh to 550,000 Ksh

-

Loan termFrom 91 – 180 days

-

Interest rateAPR 15% – 20% (max 0.05% per day)

-

Service feeNo hidden fees; all costs shown upfront

-

EligibilityValid ID and active bank account required

-

DisbursementFunds sent directly to your bank account