Boreleza

Information

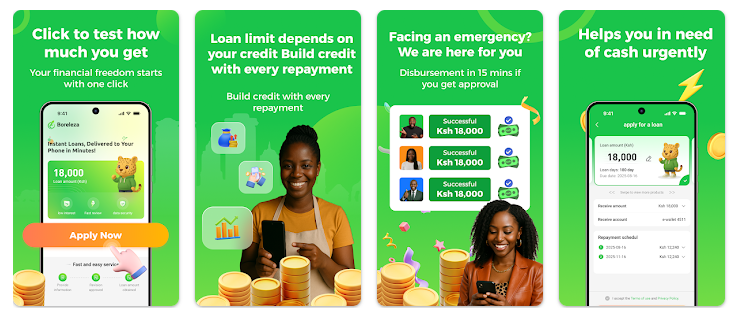

Boreleza is an online personal loan application designed specifically for people in Kenya, providing a fast, transparent, and accessible financial solution. Users can register easily directly on their mobile phones, enabling them to proactively handle unexpected expenses without the need for a credit card or complicated procedures.

All information on the Boreleza App regarding interest rates, loan terms, and fees is clearly disclosed, helping you borrow with confidence and responsibility. The application is available on Google Play, easy to download and install, and suitable for a wide range of users.

Why choose Boreleza App?

- Simple and fast loan application process directly on your mobile phone

- Track your loan and repayment schedule anytime, anywhere within the app

- Responsible assessment with transparent information before you make a decision

All transactions and data are securely encrypted. Boreleza is committed to processing personal information in accordance with its Privacy Policy and does not share data with third parties unless necessary to provide services or as required by Kenyan law.

See more:

Loan Calculator

Number of Loans

Top Best Loan Apps

All

-

Loan amounKES 2.000 to KES 90,000

-

Loan term91 to 210 days

-

Fire Loan interest rate(APR) up to 19%

-

Loan service feesFree for first-time borrowers

-

Registration requirementsYou just need to be 18 years old

-

Payment supportPayment via registered bank account

-

Loan amountFrom 1,500 KSH to 50,000 KSH

-

Loan term91 to 365 days, including possible extensions

-

Interest rateUp to 18% per year (about 0.05% per day)

-

Service feeNo upfront fees, no hidden charges

-

EligibilityKenyan residents aged 20+, with a smartphone

-

DisbursementSame-day payout to bank account or M-Pesa

-

Loan amountFrom KES 6,000 - KES 50,000

-

Loan termFrom 120 - 180 days

-

Interest rate12% – 36% comprehensive annual rate

-

Service feeOne-time processing fee

-

EligibilityKenyan citizen, age 20–65, stable income

-

Loan disbursementReceive money via M-Pesa account

-

Loan amountFrom 5,000 Ksh to 550,000 Ksh

-

Loan termFrom 91 – 180 days

-

Interest rateAPR 15% – 20% (max 0.05% per day)

-

Service feeNo hidden fees; all costs shown upfront

-

EligibilityValid ID and active bank account required

-

DisbursementFunds sent directly to your bank account