AdvancePoa

Information

AdvancePoa is an instant personal loan application in Kenya, built to provide you with long-term, flexible, and reliable financial support. Whether you need to handle urgent expenses or seize a business opportunity, the app is always ready to accompany you.

Advance Poa features a simple application process, transparent terms, and extended repayment periods, enabling borrowers to manage their finances proactively without pressure or negative impacts on their credit scores.

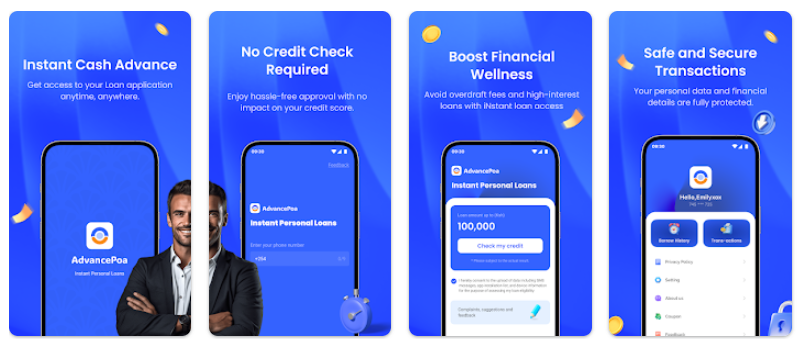

Why choose AdvancePoa App?

- Applications are processed automatically, and funds are disbursed quickly.

- Freely choose a loan plan that matches your financial capacity.

- No collateral required, no secured assets, and no guarantor needed.

- Clear interest rates with no hidden fees; all terms and conditions are fully disclosed.

- Longer loan tenures help reduce financial pressure and make budgeting easier.

How to receive a loan in just a few steps

- Install AdvancePoa from Google Play and create an account using your phone number.

- Provide basic personal and employment information.

- Select your desired loan amount and suitable repayment period, submit your application, and wait for approval.

AdvancePoa is fully committed to protecting customers’ personal information. The data you provide is used solely for identity verification and loan processing purposes, in strict compliance with data protection policies. Download and install the app, register today, and enjoy exclusive offers.

See more:

Loan Calculator

Number of Loans

Top Best Loan Apps

All

-

Loan AmountFrom 1,000 KES to 150,000 KES

-

Loan TermFrom 61 to 91 days

-

Interest RateAPR from 18.5% to 65.5%

-

Service FeeTransparent fees, no hidden charges

-

EligibilityKenyan citizens aged 18+, valid ID

-

Repayment SupportFlexible repayment via M-Pesa

-

Loan AmountFrom 5,000 Ksh to 500,000 Ksh

-

Loan TermFlexible from 91 days to 180 days

-

Interest RateAPR from 16% to 34%

-

Service FeesTransparent fees with no hidden charges

-

Eligibility RequirementsKenyan citizens aged 18 to 55

-

Repayment SupportEasy repayment via M-Pesa

-

Loan amoun1.000 KSh – 900.000 KSh

-

Loan term91 – 360 days

-

Loan interest rateFrom 12% to 36% APR

-

Loan service feesFree for first-time registration

-

Registration requirementsFrom 18 years of age and older

-

Payment supportGcash - M-Pesa

-

Loan amounKES 1,000–50,000

-

Loan term91 to 180 days

-

Loan interest rateFluctuating between 15% and 35% per year.

-

Loan service fees3.2% of the loan limit

-

Registration requirementsMust be old enough to register

-

Payment supportM-PESA Wallet and Bank Account