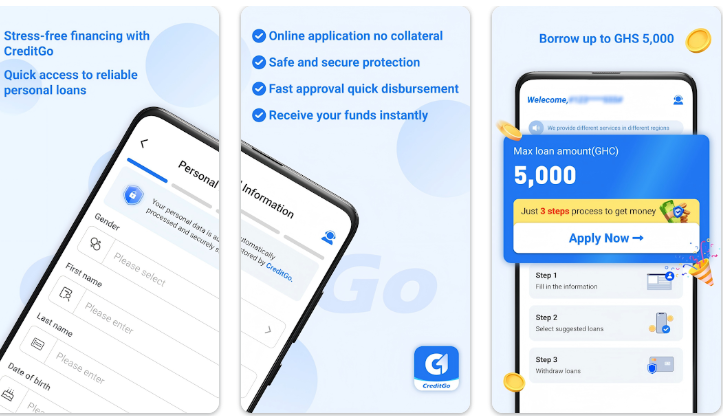

CreditGo

Information

CreditGo helps you access the financial support you need faster simpler more transparently. With CreditGo’s online loan application, the entire registration and approval process is completed 100% on your mobile phone, with no complicated paperwork or branch visits required. Simply download the app, complete your personal information, and submit your request. Once approved, the loan amount will be transferred to your account within just a few hours.

Why is CreditGo a trusted choice?

- Automated review and fast approval

- Fully online registration with simple steps

- Transparent interest rates and fees clearly disclosed before confirmation

- Secure system with advanced data encryption

- 24/7 customer support available at all times

Key features of the CreditGo application

- Online loan registration: Complete your loan application 100% on your phone, no paperwork and no branch visits required

- Fast approval: The automated system evaluates and provides results in a short time

- Quick disbursement: Funds are transferred directly to your account once the loan is approved

- Easy loan management: Track loan amounts, interest rates, loan terms, and repayment schedules directly in the app

- Transparent costs: Clearly displays interest rates, fees, and the total payable amount before loan confirmation

- Data security: Personal information is encrypted and protected under high security standards

- 24/7 customer support: Ready to assist you whenever you need help.

CreditGo not only helps you get loans quickly but also delivers a safe, transparent, and reliable financial experience. With a simple process and dedicated support services, CreditGo stays by your side for all your financial needs, helping you take control of your life with confidence. Download CreditGo today and access funds easily in just a few steps.

See more:

Loan Calculator

Number of Loans

Top Best Loan Apps

All

-

Loan amounGHC 300 to GHC 30,000

-

Loan term91 days - 180 days

-

Fire Loan interest rate0.05% - 1.2% daily based on credit

-

Loan service fees3% -8%of principal

-

Registration requirementsThere is a main phone number

-

Payment supportBank payment

-

Loan amountFrom GHS 1,000 – GHS 4,800

-

Loan periodMinimum 120 days, maximum 280 days

-

Interest rateMaximum 30% per annum (APR)

-

Service feeGHS 0 – no service fee, no management fee

-

Loan requirements18 years old and above, valid ID card

-

Loan disbursementAfter successful approval

-

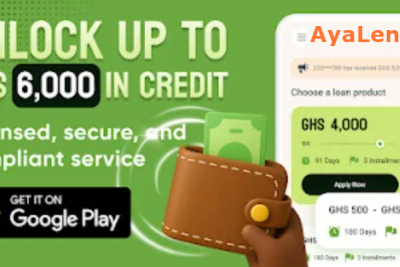

Loan AmountFrom GHS 200 to GHS 6,000

-

Loan Term91 – 365 days, flexible repayment period

-

Interest RateMaximum 26% per year (APR)

-

Service FeesNo hidden fees, completely free.

-

Loan Requirements18 years old or above, Ghanaian citizen

-

Loan DisbursementFast loan approval

-

Loan amountFrom GHS 1,000 to GHS 5,000

-

Loan termFrom 92 days to 180 days

-

Interest rateFrom 12% to 26% per year

-

Service feeApprox 5% origination fee

-

EligibilityGhanaian citizens aged 18 years

-

DisbursementFast disbursement after approval